Chinese officials provided open-source material on Hunter Biden to Trump adviser

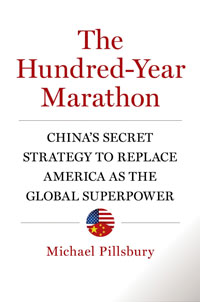

Michael Pillsbury, an informal White House adviser on China policy, told the Financial Times on Thursday that he received “quite a bit of background” in recent days from Chinese officials on the son of former Vice President Joe Biden, a leading contender for the 2020 Democratic presidential nomination.